Our Core Services & Investment Vehicles

While developing a customized financial program, we will walk with you through a step-by-step process designed to help make you feel confident in your decisions. Once your goals have been articulated, we will customize appropriate strategies that align with your vision and objectives. To provide comprehensive solutions, AlphaWealth will incorporate:

Tax Management

Investment Management

Retirement Strategies

Estate Conservation

Insurance & Annuity Strategies

With changing economic conditions and market swings, we advocate investing sensibly over the long run and

maintaining an adequate level of insurance coverage. We take a holistic approach and will provide you with ample and relevant information as you make decisions, now and in the future.

The investment vehicles used by the advisor team include Mutual Funds, Exchange Traded Funds (ETF’s) and Separately Managed Accounts. The minimum account size is $250K and our client investment portfolios range in size from $250K up to $6M. Our client base is comprised of Corporate Retirement Plans (35%), IRA Accounts (35%), Individual Accounts (20%) and Family Wealth Management Accounts & Trusts (10%).

AlphaWealth Utilizes the Following Asset Classes:

-

US Equity

US Large Stocks US Small Stocks Hedged Equity Preferred Stock

-

International Equity

Developed lnt’I Large Stocks lnt’I Small Stocks Emerging Market Stocks

-

Fixed Income

US Bonds Int’l Bonds EM Bonds High Yield Bonds Convertible Bonds Money Market/ Cash Equivalent Bank Loans

-

Alternatives

Long/Short Equity Long/Short Credit Managed Futures Absolute Return Merger Arbitrage MLPs

-

Real Assets

US Real Estate lnt’I Real Estate REITs Commodities TIPs

Asset Allocation Recommendations

AlphaWealth will recommend a dynamic target allocation to each asset class as well as an allocation within each asset class. Based on your unique plan we will recommend a customized allocation strategy that addresses your criteria for capital preservation and growth, income and risk tolerance. Not all asset classes are utilized in the construction of all portfolios.

Other Client Solutions We Offer

Client Services

- Investment analysis and planning

- IRA rollover services

- Legacy and estate planning

- Business succession planning

- Comprehensive insurance reviews

- Comprehensive financial plans for individuals, families, business owners and retirees

- Analysis of executive benefit plans

- Philanthropic and charitable giving advisory

- Development and Administration of Company Retirement Plans

- Coordination with Other Professionals (Legal/Accounting)

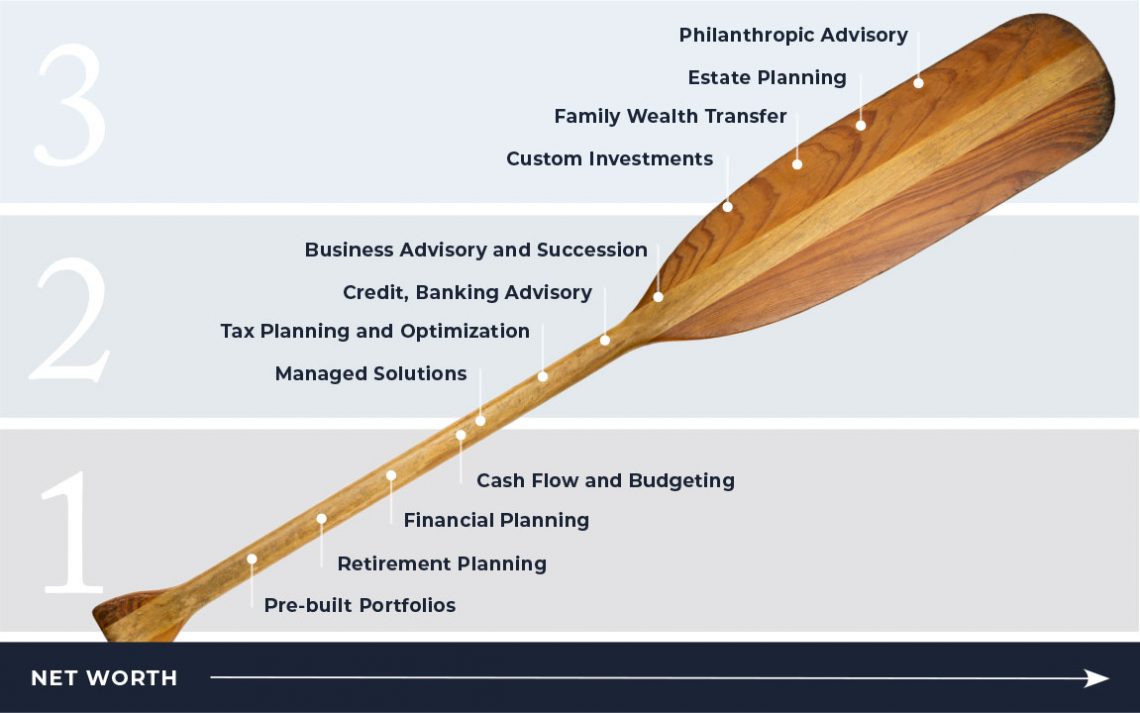

Our Tiers of Service